An Unbiased View of Transaction Advisory Services

Fascination About Transaction Advisory Services

Table of ContentsThe Only Guide to Transaction Advisory ServicesThe Greatest Guide To Transaction Advisory ServicesThe 6-Second Trick For Transaction Advisory ServicesThe Main Principles Of Transaction Advisory Services The smart Trick of Transaction Advisory Services That Nobody is Talking About

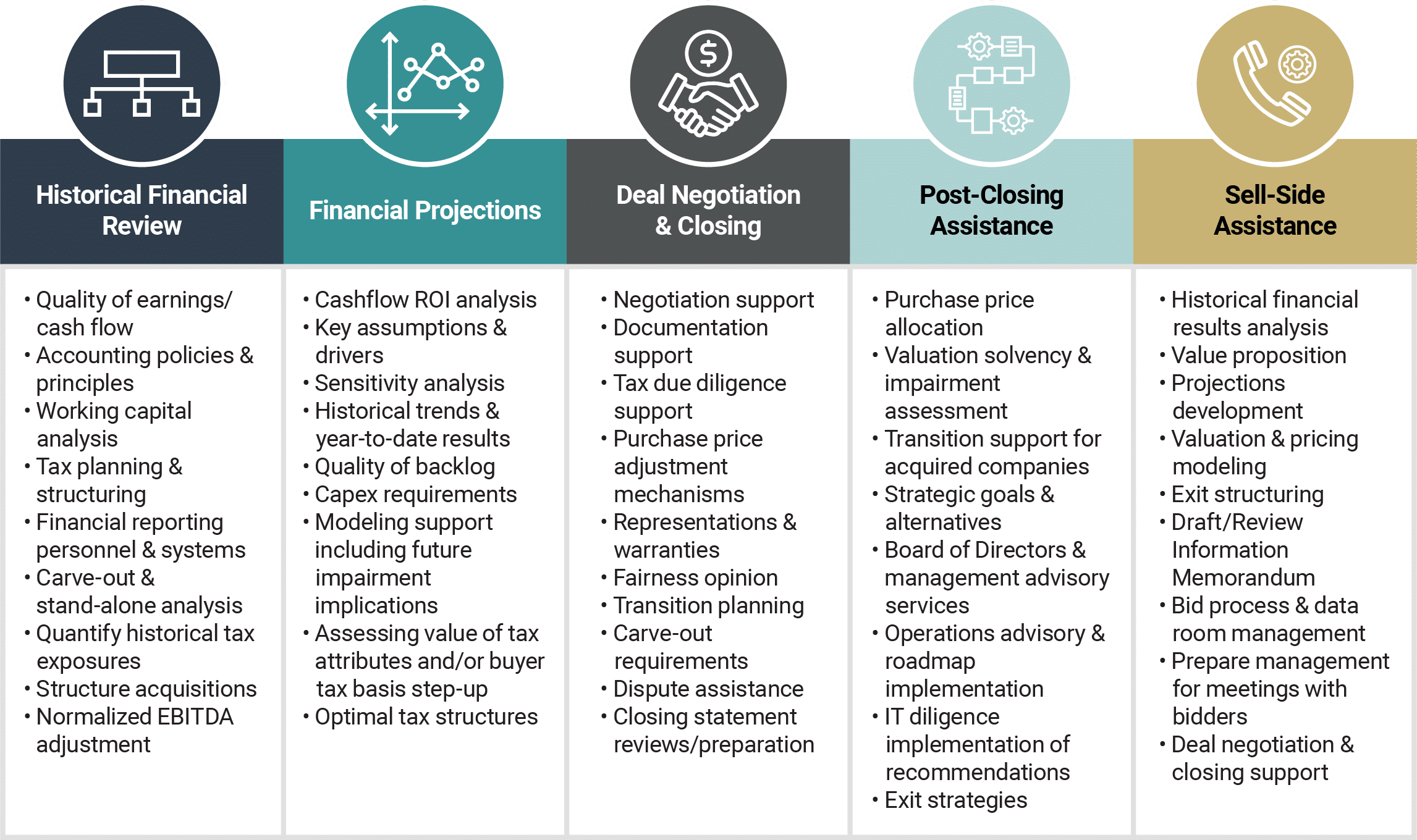

This action makes sure the business looks its best to prospective purchasers. Obtaining the company's worth right is essential for an effective sale.Purchase experts step in to help by getting all the required details arranged, addressing questions from buyers, and setting up brows through to business's place. This constructs trust fund with buyers and keeps the sale relocating along. Obtaining the most effective terms is crucial. Purchase experts use their knowledge to aid business owners deal with hard negotiations, satisfy purchaser expectations, and structure offers that match the owner's goals.

Meeting lawful rules is crucial in any kind of business sale. Transaction advisory solutions deal with legal experts to create and assess contracts, agreements, and other lawful papers. This reduces threats and makes certain the sale adheres to the legislation. The duty of purchase consultants extends past the sale. They assist local business owner in planning for their following steps, whether it's retirement, starting a brand-new venture, or handling their newfound wealth.

Transaction consultants bring a wide range of experience and understanding, guaranteeing that every facet of the sale is dealt with properly. Through critical preparation, appraisal, and settlement, TAS aids business owners achieve the highest feasible price. By guaranteeing lawful and governing conformity and managing due diligence alongside other deal employee, purchase consultants lessen possible dangers and liabilities.

Transaction Advisory Services Fundamentals Explained

By comparison, Large 4 TS groups: Deal with (e.g., when a potential buyer is conducting due persistance, or when a deal is shutting and the customer requires to integrate the company and re-value the seller's Annual report). Are with fees that are not connected to the bargain shutting efficiently. Make charges per interaction somewhere in the, which is less than what investment banks make even on "little deals" (but the collection possibility is also much higher).

The interview questions are extremely comparable to financial investment financial interview questions, however they'll focus much more on bookkeeping and appraisal and much less on subjects like LBO modeling. Anticipate concerns about what the Change in Working Capital means, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like test equilibriums and exactly how to go through events using debits and credit reports as opposed to monetary statement adjustments.

Transaction Advisory Services Things To Know Before You Get This

Professionals in the TS/ FDD teams might additionally interview management about whatever over, and they'll create a detailed report with their findings at the end of the process.

The pecking order in Transaction Solutions differs a bit from the ones in financial investment banking and private equity jobs, and the general shape appears like this: The entry-level function, where you do a lot of data and monetary analysis (2 years for a promotion from here). The next level up; similar work, but you get the more interesting bits (3 years for a promo).

Specifically, it's tough to get promoted beyond the Supervisor degree since few individuals leave the job at that stage, and you need to begin showing evidence of your capacity to produce income visit their website to advancement. Let's begin with the hours and way of living considering that those are much easier to define:. There are periodic late nights and weekend break job, yet nothing like the frenzied nature of investment financial.

There are cost-of-living adjustments, so expect lower compensation if you're in a less expensive area outside significant financial centers. For all settings other than Companion, the base salary comprises the bulk of the total compensation; the year-end reward may be a max of 30% of your base salary. Typically, the best method to increase your profits is to switch to a various firm and discuss for a greater wage and incentive

Some Known Questions About Transaction Advisory Services.

You can get into company growth, but financial investment banking gets extra difficult at this phase because you'll be over-qualified for Expert functions. Corporate financing is still a choice. At this stage, you must simply remain and make a run for a Partner-level role. If you want to leave, perhaps transfer to a client and do their evaluations and due persistance in-house.

The main problem is that due to the fact that: You usually require to sign up with another Big 4 group, such as audit, and job there for a couple of years and after that move into TS, work there for a couple of years and after that relocate right into IB. And there's still no assurance of winning this IB role due to the fact that it depends upon your region, clients, and the working with market at the time.

Longer-term, there is likewise some risk of and because reviewing a company's historic monetary info is not precisely rocket science. Yes, human beings will constantly need to be entailed, however with advanced technology, reduced official source head counts could possibly support client engagements. That stated, the Transaction Providers group beats audit in regards to pay, work, and leave opportunities.

If you liked this write-up, you could be thinking about analysis.

Some Ideas on Transaction Advisory Services You Need To Know

Develop advanced monetary structures that aid in determining the actual market value of a company. Give consultatory work in connection to company evaluation to help in negotiating and prices structures. Discuss the most ideal type of the bargain and the kind of consideration to employ (cash money, supply, make out, and others).

Carry out integration preparation to determine the procedure, system, and organizational adjustments that may be required after the offer. Set standards for integrating divisions, innovations, and organization procedures.

Determine potential reductions by reducing DPO, DIO, and DSO. Assess the potential other client base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence uses vital insights right into the performance of the company to be acquired worrying risk evaluation and worth creation. Determine short-term adjustments to finances, financial institutions, and systems.